Increasingly, investors are asking if ESG is a factor. We answer this question using the criteria set forth by our Research Affiliates colleagues in their 2016 Graham and Dodd Scroll–winning article, “Will Your Factor Deliver? An Examination of Factor Robustness and Implementation Costs.” We conclude that ESG is not a factor.

We do believe, however, that ESG could be a powerful theme as new owners of capital—in particular, women and millennials—prioritize ESG in their portfolios over the next two decades. Progress in aligning definitions of “good” and “bad” ESG companies will also enhance the ability of the ESG theme to deliver positive investor outcomes.

We conclude that ESG does not need to be a factor for investors to achieve their ESG and performance goals.

Abstract

As we hit the halfway point of this remarkable year, the health of our planet, the well-being of our communities, and the necessity for meaningful societal change are all top of mind and assuming a greater sense of urgency. Accordingly, many investors desire to take personal action by incorporating environmental, social, and governance (ESG) considerations into their investment portfolios. Unfortunately, they are confronted by a confusing ESG landscape with conflicting claims—similar to the multitude of competing health care studies. This confusion may be slowing down their good intentions. As a factor index provider with ESG offerings, we attempt to answer the question “Is ESG a factor?” by synthesizing what we, and our colleagues, have discovered over the years.

Create your free account or log in to keep reading.

Register or Log in

”Can drinking red wine daily stave off heart disease? A newly released study answers that very question. We’ll cover it right after this commercial break.” Does this teaser sound familiar from your favorite morning television or radio show? Does this attention-grabber peak your interest to wait a few minutes, bear the commercials, and hear the story? The media has a natural inclination to use science to engage audiences. Consequently, we’re bombarded with new studies, especially as they relate to our health, a topic of interest to everyone and, of course, top of mind today.

The findings may entertain, but do they inform? Nagler (2014) finds that contradictory scientific claims on red wine, coffee, fish, and vitamins, all touted by the media, led to substantial confusion on the part of consumers. Indeed, the claims led to such confusion that many consumers grew skeptical of even vetted health advice such as exercising and eating fruits and vegetables. Ironically, learning more about nutrition via competing claims led to more confusion, lack of trust, and less likely adoption of better eating and exercising habits.

As we hit the halfway point of a remarkable 2020 and become more acclimated to our new circumstances, we’re concerned about the health of our planet, the well-being of our communities, and the necessity for meaningful societal change. Accordingly, many desire to put these concerns into their investment portfolios using environmental, social, and governance (ESG) considerations and tools. Investors, however, find a confusing ESG landscape with conflicting claims—similar to the multitude of competing health care studies—that may be slowing down good intentions.

As an example, it was John’s turn to represent Research Affiliates at the annual Inside ETFs event in Florida earlier this year.1 The overwhelming points of emphasis from both ETF and index providers throughout the presentations were factor investing and ESG. Several sessions covered one or the other, often both. Regardless of whether the headliner was ESG or factor investing, inevitably a question popped up at the end of the session from either the moderator or the audience: “Is ESG a factor?” If John heard the question six times, he’d venture to guess he heard more than 12 answers! Accordingly, as a factor index provider with ESG offerings, we attempt to answer the question, synthesizing what we, and our colleagues, have discovered over the years.

What Is a Factor, and Can We Count on It in the Future?

Factors are stock characteristics associated with a long-term risk-adjusted return premium. An example is the value premium, which rewards investors who buy stocks that have a low price relative to their fundamentals. Two theories are advanced to explain the value effect: one is risk based and the other is behavior based.

The risk-based explanation posits that value companies are cheap for a reason, such as lower profitability and/or greater leverage, and thus investors require that they earn a premium to compensate for the risk of investing in them (a risk premium). The behavioral-based explanation posits that investor biases, such as being overly pessimistic about value companies and overly optimistic about growth companies, create stock mispricings, and that value stocks outperform once investors’ expectations are not met and mean reversion occurs.

Popular factors, such as value, low beta, quality, and momentum, have been well documented and vetted by both academics and practitioners. Research by Beck et al. (2016) provides a useful framework for determining if a factor is robust. For ESG to be a factor, it should satisfy these three critical requirements:

- A factor should be grounded in a long and deep academic literature.

- A factor should be robust across definitions.

- A factor should be robust across geographies.

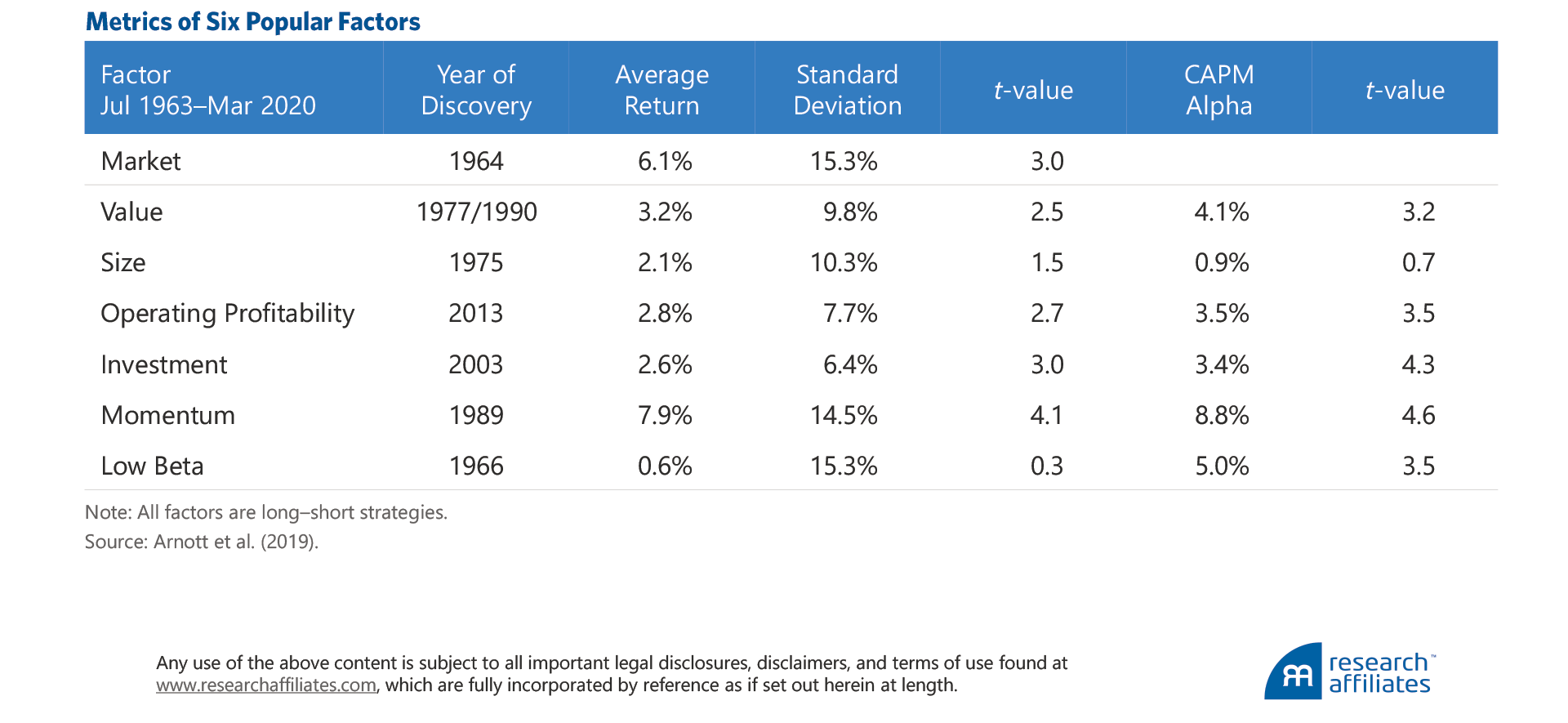

A factor should be grounded in a long and deep academic literature. Traditional factors, such as value, low beta, and momentum, have been thoroughly researched and have a track record spanning several decades; very little debate currently exists regarding their robustness. Beyond the size factor,2 all of the factors in the following table have a positive CAPM alpha and are statistically significant at the 95% t-stat level (1.96).

In examining the vast body of research on ESG, we find little agreement regarding its robustness in earning a return premium for investors. Research by Clark, Feiner, and Viehs (2015), Friede, Busch, and Bassen (2015), and Khan, Serafeim, and Yoon (2016) finds that ESG is additive to returns, while research by Brammer, Brooks, and Pavelin (2006), Fabozzi, Ma, and Oliphant (2008), and Hong and Kacperczyk (2009) demonstrates that ESG detracts from returns. Neither is there evidence to suggest a risk-based or behavioral-based explanation for the ESG factor.

Arguments are put forth that certain situations could lead to positive ESG-related stock price movements, such as increased popularity of strong ESG companies as more investors adopt ESG (more on this topic later). These price movements, however, would be one-time adjustments and cannot be expected to deliver a reliable and robust premium over time.

ESG is not an equity return factor in the traditional, academic sense.

”Factors should be robust across definitions. Slight variations in the definition of a factor should still produce similar performance results. Using the value factor as an example, the three valuation metrics of price-to-book ratio, price-to-earnings ratio, and price-to-cash flow ratio all yield similar performance results in assessing the factor’s long-horizon performance.

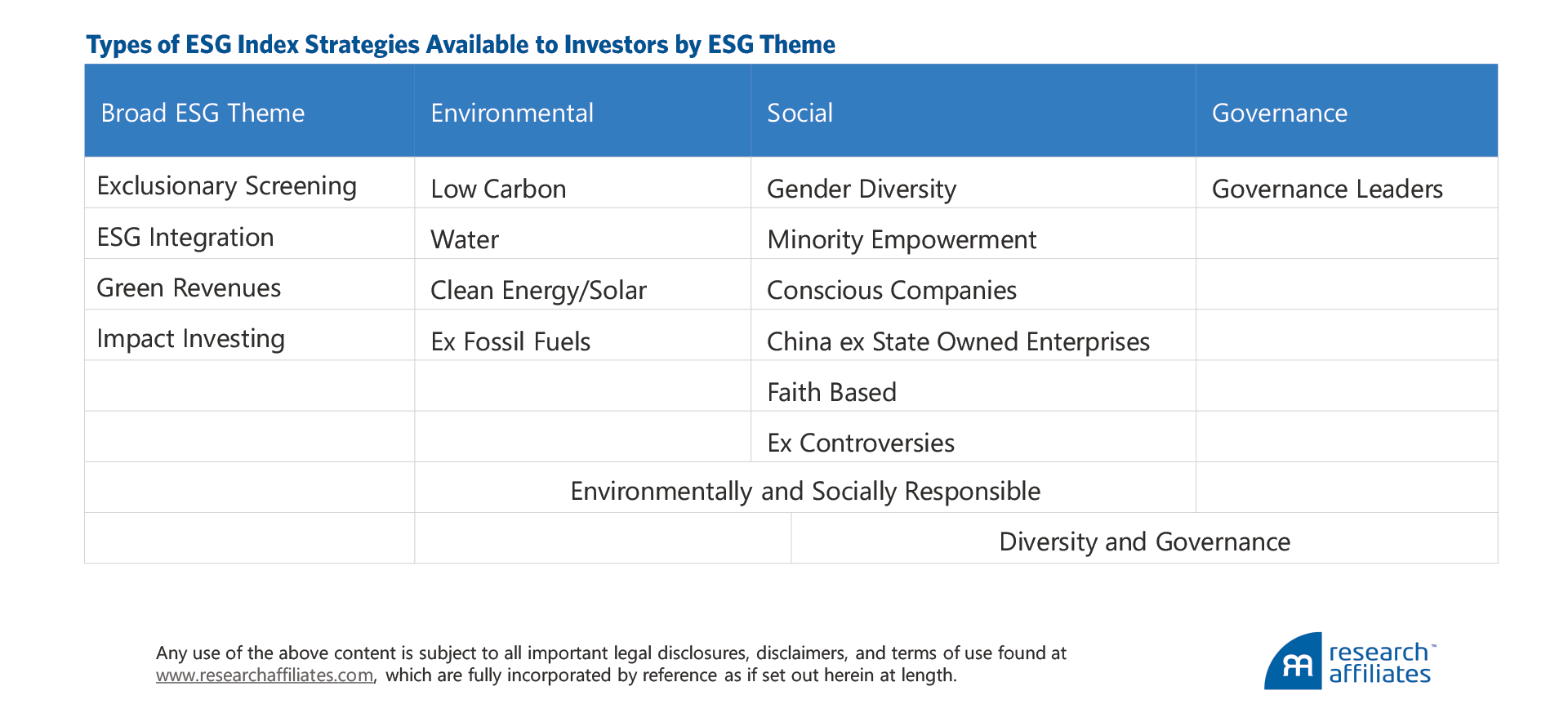

ESG has no common standard definition and is a broad term that encapsulates a range of themes and subthemes.3 ESG ratings providers examine hundreds of metrics when determining a company’s ESG score. Conducting a quick web search yields several ESG strategies whose underlying themes are quite distinct and different. These index strategies align more closely with investor preferences than with a particular factor.

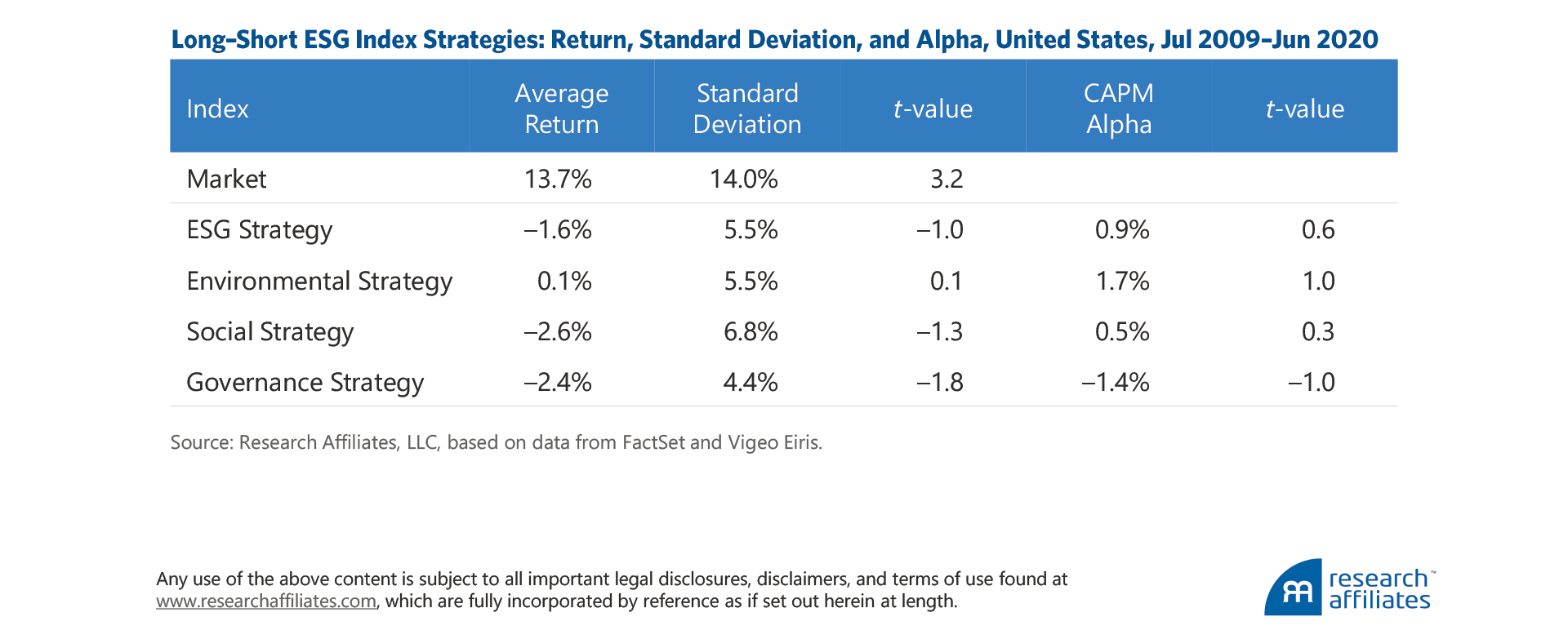

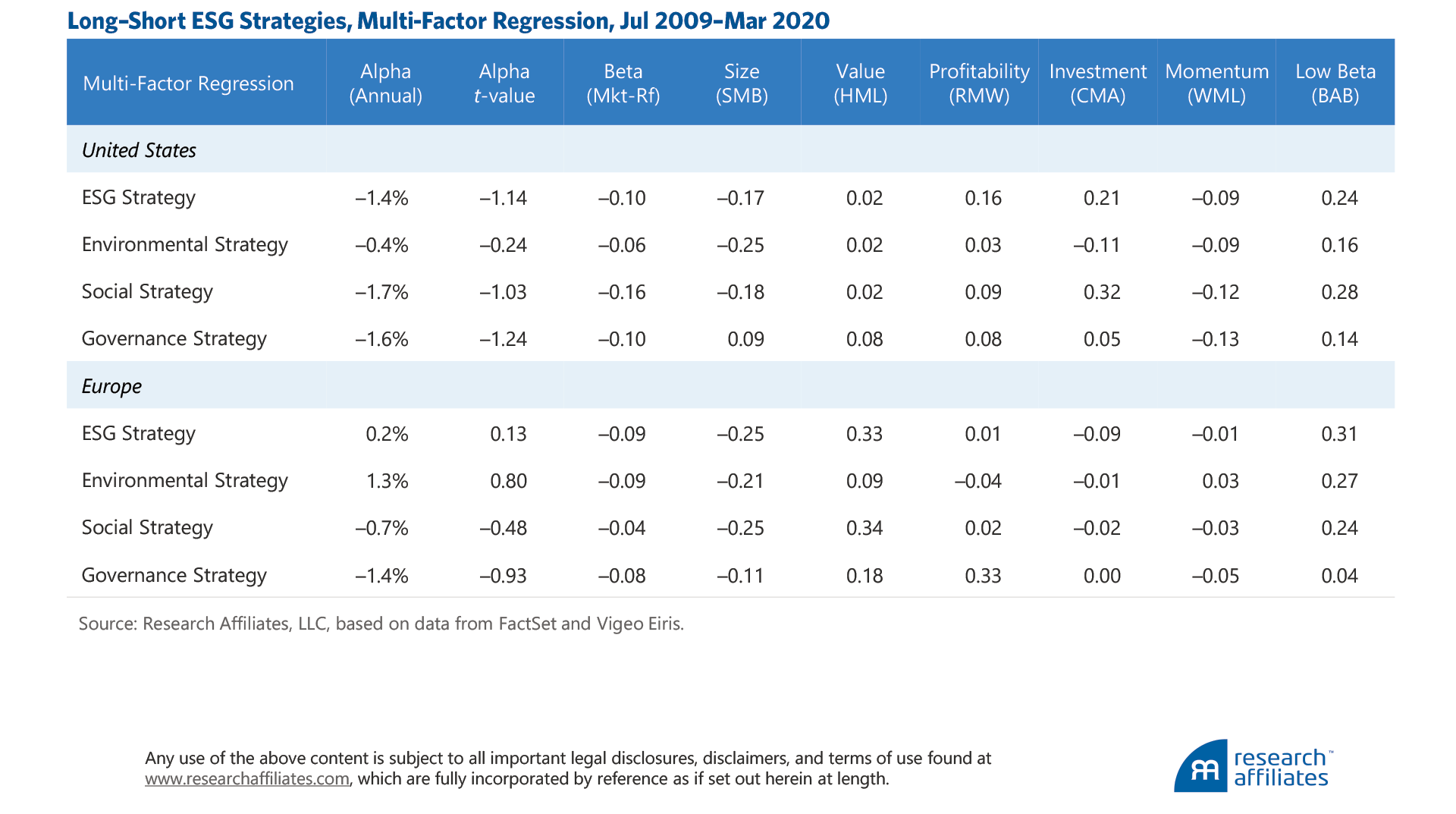

To illustrate this, we construct a simple test on four variants of ESG definitions. We build long–short portfolios by selecting the top 30% and bottom 30% of US companies by market capitalization each year, after ranking by overall ESG rating. We also build three similarly constructed long–short portfolios, ranking companies on each individual ESG characteristic of environmental, social, and governance.4 None of these strategies displays a materially positive CAPM alpha except for the environmental long–short strategy, and no strategy is statistically significant at the 95% t-stat level (1.96).

Unfortunately, none of the simulated strategies we tested has a long track record because the ESG data history is quite short. This lack of history is a significant impediment to conducting research in ESG investing, limiting our study period to 11 years from July 2009 to June 2020. Because multiple decades of data are needed to conduct a proper test, the lack of significance in the t-values is not surprising. Only after several decades of quality ESG data will it be possible to accurately test the claim that ESG is a robust factor.

In addition to the problem of a short data history, the lack of consistency among ESG ratings providers also hinders our ability to determine if ESG is a robust factor. Research Affiliates published findings earlier this year that showed the correlation of company ratings between ESG ratings providers is low (Li and Polychronopoulos, 2020). We illustrated this by comparing two companies, Wells Fargo and Facebook, and showed that one ESG ratings provider rates Wells Fargo positively and Facebook negatively, while a second ratings provider ranked them the opposite way. In addition, we demonstrated that a portfolio construction process using the same methodology, but different ESG ratings providers, can yield different results. While beyond the scope of this article, had we used a different ESG ratings provider for the analysis in the preceding table, we likely would have gotten different results!

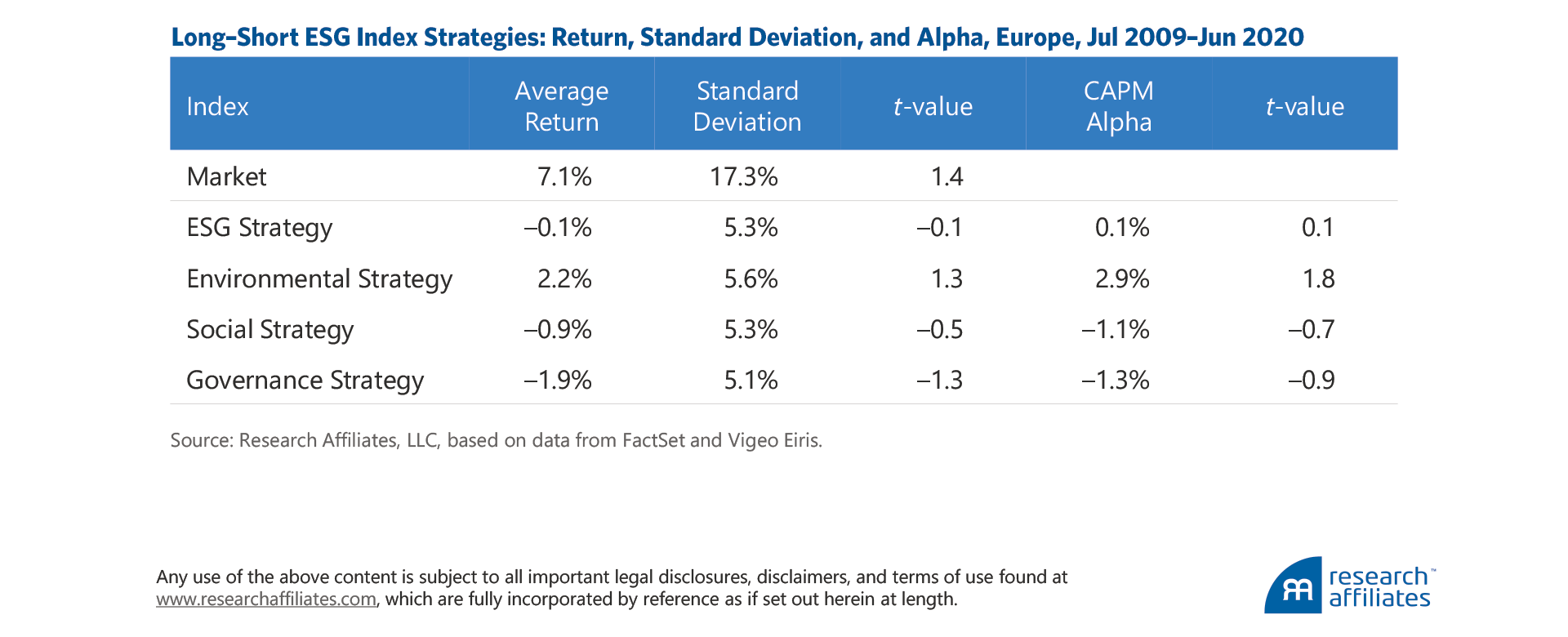

Factors should be robust across geographies. We conduct the same study using European companies. The results are largely consistent with the US results. None of the strategies tested has a materially positive CAPM alpha except for the environmental strategy, and no strategy tested exhibits statistically significant CAPM alpha at the 95% t-stat level.

We should note that for the US and European analysis we conduct a simple single-factor linear regression against the market return. In the appendix we present the results of a stricter test using a multi-factor regression that incorporates the value, size, profitability, investment, momentum, and low beta factors. The multi-factor regression results indicate low or negative alpha for the majority of the strategies.

Having put ESG investing strategies through a framework to assess factor robustness, we find that ESG fails all three tests outlined by Beck et al. (2016): 1) evidence of an ESG return premium is not supported by a long and deep academic literature, 2) ESG performance results are not robust across definitions, and 3) ESG performance results are not robust across regions.

ESG Is Not a Factor, but Could Be a Powerful Theme

Even though we are unable to apply the factor framework to ESG, these strategies, however heterogeneous, may still produce superior returns. Non-robust, and even robustly negative, strategies will invariably cycle through periods—think three-to-five year stretches—of outperformance. And over the very long term, possibly decades, stocks that rank well on ESG criteria may also outperform.

We witness two principle arguments in favor of superior risk-adjusted returns for companies that rate well on ESG metrics. First, as some claim, there may be latent risks in companies that rate poorly on ESG metrics (Orsagh et al., 2018). In other words, ESG risk needs to be incorporated into security selection.

Let’s consider carbon. Historical fundamental analysis developed during a predominantly stable climate backdrop may miss the investment risk associated with carbon and thereby deliver poor results if the risk materializes. Coal has been a declining source of energy production in the United States for years, accounting for 52% of the nation’s total electricity generation in 1990, but just 23% at the end of 2019.5 The percentage will continue to decline as energy providers move toward cleaner and more-energy-efficient alternatives to combat climate change, leaving coal companies with assets of decreasing value. Investment managers who do not consider and integrate the ESG risk of, in this case, climate change may be blindsided.

“The theme is the massive coming adoption of ESG investing on the part of new owners of capital.”

Not recognizing a specific type of risk implies a mispricing effect. This mispricing seems to be highly idiosyncratic in nature and probably best exploited via the forward-looking framework of active management. Such “ESG alpha” has the potential to be sizeable, especially if very few managers are incorporating ESG criteria into their investment processes—but that’s not the case. According to Cerulli, 83% of investment managers are embedding ESG criteria into their fundamental processes.6

At the time of this publication, over 2,200 investment managers have signed on to the United Nations (UN) PRI | Principles for Responsible Investing, which encourages signatories to “incorporate ESG issues into investment analysis and decision-making processes.” Indeed, investment manager signatories managed approximately US$80 trillion as of March 31, 2020.7 Such widespread use of ESG criteria in the investment management process means that identifying ESG skill will likely be as difficult as identifying other types of investor skill.8 Neither does it speak to the ability of investors to harvest the alpha, if found. Will investors have the patience to wait out manager ESG risk assessments, especially given the very long horizon for some of these risks?

A large shift in investor preference toward ESG is occurring as two distinct groups—women and millennials—take greater control of household assets. Accordingly, Bank of America (2019) recently noted a “tsunami of assets is poised to invest in ‘good’ stocks” and concluded that “three critical investor cohorts care deeply about ESG: women, millennials, and high net worth individuals. Based on demographics, we conservatively estimate over $20tn of asset growth in ESG funds over the next two decades—equivalent to the S&P 500 today.”9 Similarly, an Accenture study concluded that US$30 trillion in assets will change hands, a staggering amount which, at its peak between 2031 and 2045, will witness 10% of total US wealth transferred every five years.10

Not only are investor preferences shifting in favor of ESG strategies, regulatory efforts in Europe aim to bring greater standardization and transparency to ESG products, which is likely to increase demand. As of 2019, UK government pension funds are required to integrate ESG considerations into their investment management approach (McNamee, 2019). Starting in March 2021, the European Union will require investment managers to provide ESG disclosures related to their investment products. The effort “aims to enhance transparency regarding integration of environmental, social, and governance matters into investment decisions and recommendations” (Maleva-Otto and Wright, 2020). In 2018, the European Commission set up a Technical Expert Group tasked with several ESG initiatives including creating index methodology requirements for low carbon benchmarks, increasing transparency in the green bond market, and creating an EU taxonomy to help companies transition to a low carbon economy.

Outside of Europe there has been less movement on the regulatory front, but good progress made on standard setting. In the United States, public pension funds have taken the lead on ESG integration and in 2018 held 54% of all ESG-related investments in the United States (Bradford, 2019). The UN has created the Sustainable Development Goals, a blueprint for improving the planet, both environmentally and socially, by 2030. The 17 goals—including reducing poverty, improving education, creating affordable and clean energy, and creating sustainable cities and communities—have been adopted by all UN member states.

“ESG does not need to be a factor for investors to achieve their ESG and performance goals.”

The numbers are large, and the implication that the new owners of wealth will favor "good" ESG stocks will in turn likely lead to a very different supply–demand dynamic than in the past. More demand for good ESG companies may result in an upward, one-time positive shock to relative valuations of these companies and the funds that invest in them. We previously discussed that factors and smart beta strategies can experience such a revaluation alpha (Arnott et al., 2016).11 This is classic thematic investing, following in the footsteps of cloud, artificial intelligence, and robotics themes, but it’s not factor investing.

The theme in this case is the massive coming adoption of ESG investing on the part of new owners of capital. Getting ahead of that demand could be substantially profitable on two conditions. First, the perceived demand is not already reflected in stock prices. Second, the market’s perception of good ESG companies is fairly consistent so that these inflows more or less benefit the same companies.

As we have explained, we currently see incredibly inconsistent definitions of good and bad ESG companies. Yes, a rising tide lifts all boats, but they all have to be in the water and in the same harbor! It may very well be that the best options for thematic investing in ESG are for narrower—and therefore homogenous—groups of securities. Low carbon, sustainable forestry, or gender equality may be easier to exploit in a thematic manner than the entire ESG company universe.

Incorporate ESG into a Variety of Equity Index Strategies

At Research Affiliates, we believe ESG is an important investing consideration despite dismissing it as a factor or lacking confidence in its ability to currently deliver as a theme. One of our core investment beliefs is that investor preferences are broader than risk and return. As value investors, we believe that prices vary around fair value and that investing in unpopular companies and not following the herd is a strategy that will be rewarded as prices mean revert over a market cycle (Brightman, Masturzo, and Treussard, 2014). Of course, investor preferences extend beyond value investing, and as we have shown, many investors have a preference for ESG strategies for many reasons, such as the desire to bring about societal change, mindfulness of the environment, promotion of good corporate governance, or all of the above.

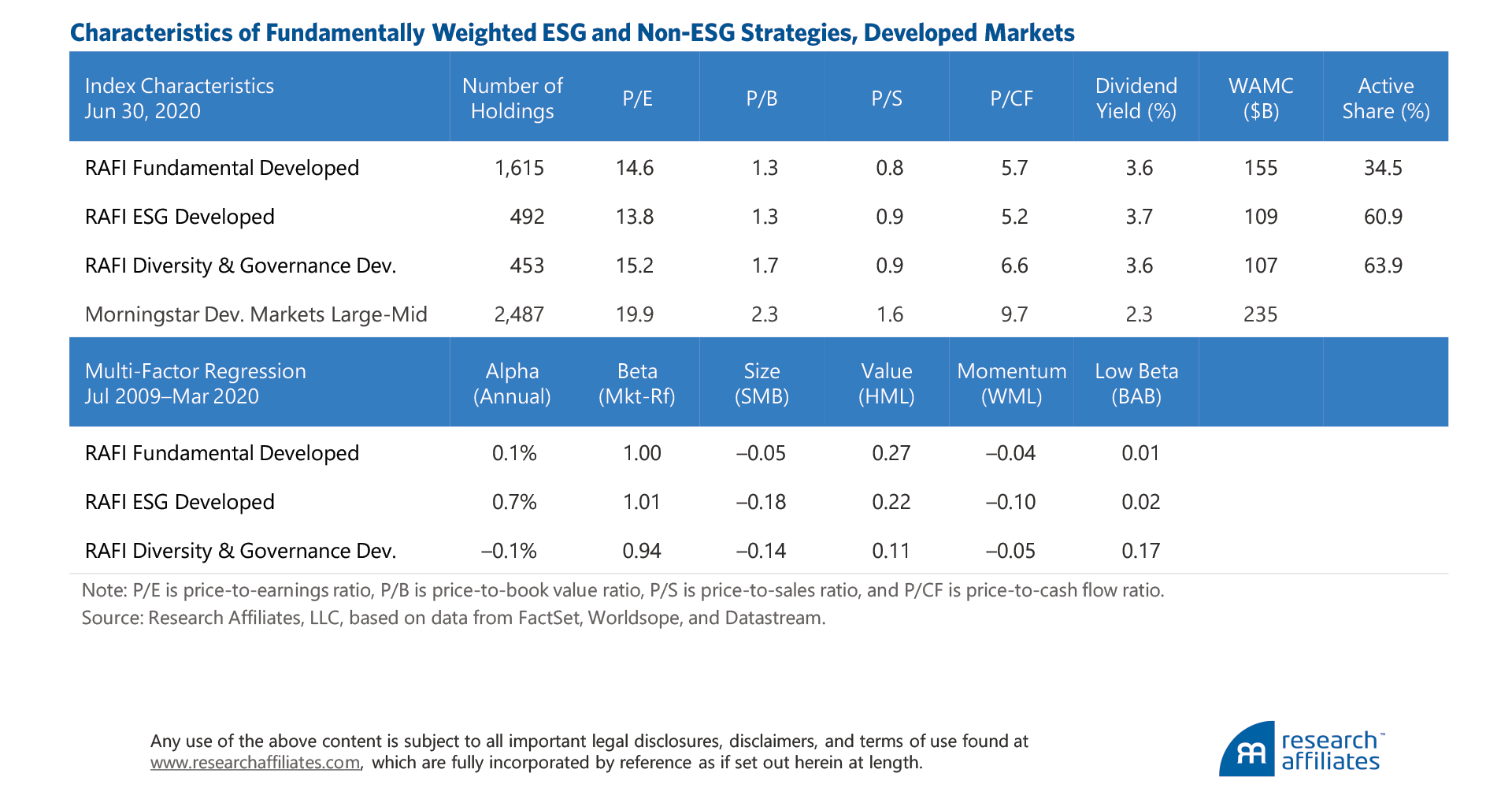

Investors can satisfy their ESG preferences while still maintaining the characteristics of their preferred investment strategy. We illustrate this by comparing the characteristics of three strategies: RAFI™ Fundamental Developed Index, RAFI ESG Developed Index, and RAFI Diversity & Governance Developed Index. All three strategies utilize the Fundamental Index™ approach, which selects and weights companies by fundamental measures of company size rather than market capitalization. The RAFI Fundamental Developed Index does not incorporate any ESG considerations. The RAFI ESG Developed Index is a broad-based ESG index that tilts toward companies with strong overall ESG scores. The RAFI Diversity & Governance Developed Index reflects a preference for companies that score well across several metrics of gender diversity and strong corporate governance.

All three strategies share similar characteristics. The Fundamental Index methodology is a contrarian approach that uses fundamental weights to act as rebalancing anchors against market price movements. Fundamental Index strategies typically trade at a discount to cap-weight. All three strategies maintain similar valuation discounts and dividend yields, with the only noticeable differences being index concentration. Given that the ESG and Diversity & Governance indices exclude many securities that perform poorly across multiple ESG considerations, they have a much higher active share. In addition, all three strategies maintain similar factor exposures, mainly positive loadings on value and negative loadings on momentum.

The Diversity & Governance index, which incorporates a tilt toward lower-volatility companies, also has a high exposure to the low beta factor. The bottom line is that investors who would like to incorporate ESG into their investment decisions can do so and retain their desired investment characteristics. Accordingly, they likely maintain a similar expected return outcome (although with some short-term deviations in performance) whether their preferred approach is traditional passive, smart beta, or active. ESG does not need to be a factor for investors to achieve their ESG and performance goals.

Conclusion

Let’s hope the events of 2020—Australian wildfires, a global pandemic, a searing recession, and social protests denouncing racial inequality—lead to positive societal changes and perhaps more refinement to and greater consistency in ESG ratings. Indeed, once the dust settles, we expect these forces to accelerate an already simmering ESG investment movement—but action will require clarity around exactly what ESG is and what it is not. Currently, various stakeholders are sending a whole host of mixed messages. Investors, particularly fiduciaries, need education and alignment. If ESG remains a heterogeneous basket of claims, we will likely never see it fulfill its vast promise.

We have debunked one of these messages: ESG is not an equity return factor in the traditional, academic sense. We have shown that, unlike vetted factors such as value, low beta, quality, or momentum, ESG strategies lack sufficient historical data, impeding our ability to make a similar conclusion of robustness. Nevertheless, ESG can be a very powerful theme in the portfolio management process in the years ahead. Furthermore, we believe a variety of equity styles can very effectively capture ESG criteria. We believe our conclusions will add clarity around the question “Is ESG a factor?” and therefore quicken the pace of ESG integration in equity portfolios.

Appendix

We examine the results of a multi-factor regression compared to long–short ESG portfolios in the United States and Europe. This approach results in low or negative alpha from the majority of the strategies. The environmental strategy in Europe is the only strategy with annual alpha greater than 1.0%, however, the results are not statistically significant at the 95% t-stat level (1.96). Most of the strategies exhibit positive loadings on the low beta, profitability, and investment factors, meaning that ESG portfolios tend to exhibit low-volatility and high-quality characteristics, bringing merit to the argument of ESG as a risk mitigation strategy.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

Endnotes

- The notion of hundreds of attendees gathering in a ballroom and congregating around coffee and snack tables seems, quoting George Lucas, like a long time ago in a galaxy far, far away.

- Although size is a commonly accepted factor by many investors, Research Affiliates has expressed concern that the size factor may lack robustness (Kalesnik and Beck, 2014).

- The attention given to specific ESG considerations has varied over time. For example, climate change has been a leading ESG issue for several years, while gender equality and even more recently racial equality, are issues now starting to gain momentum. Discussing whether gender or racial inequality was a priced factor decades in the past is irrelevant if we wish to support investors who desire to have an impact today.

- We use the Russell 1000 Index as the starting universe for selection within the US, and we use the FTSE All World Developed Europe Index as the starting universe for selection within Europe. We exclude companies without an ESG rating, and strategies rebalance once a year on June 30. We use ESG ratings data from Vigeo Eiris.

- Source is US Energy Information Administration.

- Source is “Environmental, Social, and Governance (ESG) Investing in the United States,” Cerulli Associates (2019).

- Source is UN PRI accessed on July 9, 2020.

- In 2018, responsible investment strategies used in actively managed equity assets included US$7.4 trillion for integration; US$4.4 trillion for screening and integration; US$1.8 trillion for screening, thematic, and integration; and US$0.4 trillion for thematic and integration. Source is UN PRI.

- Source is Bank of America Merrill Lynch (September 23, 2019).

- Source is “The ‘Greater’ Wealth Transfer: Capitalizing on the Intergenerational Shift in Wealth,” Accenture (2015).

- Arnott et al. (2016) note that revaluation alpha can cut both ways in that a strategy trading at a substantial premium to the market might perform poorly if valuations mean revert toward market multiples.

References

Arnott, Robert, Noah Beck, Vitali Kalesnik, and John West. 2016. “How Can ‘Smart Beta’ Go Horribly Wrong?” Research Affiliates Publications (February).

Arnott, Robert, Campbell Harvey, Vitali Kalesnik, and Juhani Linnainmaa. 2019. “Alice’s Adventures in Factorland.” Research Affiliates Publications (February). Available at SSRN.

Bank of America. 2019. “10 Reasons You Should Care about ESG.” ESG Matters–US (September 23).

Beck, Noah, Jason Hsu, Vitali Kalesnik, and Helge Kostka. 2016. “Will Your Factor Deliver? An Examination of Factor Robustness and Implementation Costs.” Financial Analysts Journal, vol. 72, no. 5 (September/October):58–82.

Bradford, Hazel. 2019. “Public Funds Taking the Lead in Spectacular Boom of ESG.” Pensions and Investments (April 19).

Brammer, Stephen, Chris Brooks, and Stephen Pavelin. 2006. “Corporate Social Performance and Stock Returns: UK Evidence from Disaggregate Measures.” Financial Management, vol. 35, no. 3 (September):97–116.

Brightman, Chris, James Masturzo, and Jonathan Treussard. 2014. “Our Investment Beliefs.” Research Affiliates Fundamentals (October).

Clark, Gordon, Andreas Feiner, and Michael Viehs. 2015. “From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance.” Available on SSRN.

Fabozzi, Frank, K.C. Ma, and Becky Oliphant. 2008. “Sin Stock Returns.” Journal of Portfolio Management, vol. 35, no. 1 (Fall):82–94.

Friede, Gunnar, Timo Busch, and Alexander Bassen. 2015. “ESG and Financial Performance: Aggregated Evidence from More Than 2000 Empirical Studies.” Journal of Sustainable Finance and Investment, vol. 5, no. 4:210–233.

Hong, Harrison, and Marcin Kacperczyk. 2009. “The Price of Sin: The Effects of Social Norms on Markets.” Journal of Financial Economics, vol. 93, no. 1 (July):15–36.

Kalesnik, Vitali, and Noah Beck. 2014. “Busting the Myth about Size.” Research Affiliates Simply Stated (November).

Khan, Mozaffar, George Serafeim, and Aaron Yoon. 2016. “Corporate Sustainability: First Evidence on Materiality.” Accounting Review, vol. 91, no. 6 (November):1697–1724.

Li, Feifei, and Ari Polychronopoulos. 2020. “What a Difference an ESG Ratings Provider Makes!” Research Affiliates Publications (January).

Maleva-Otto, Anna, and Joshua Wright. 2020. “New ESG Disclosure Obligations.” Harvard Law School Forum on Corporate Governance (March 24).

McNamee, Emmet. 2019. “UK’s New ESG Pension Rules: Four Measures to Ensure Their Success.” PRI Blog (October 1).

Nagler, Rebekah. (2014). “Adverse Outcomes Associated with Media Exposure to Contradictory Nutrition Messages.” Journal of Health Communication, vol. 19, no. 1:24–40.

Orsagh, Matt, James Allen, Justin Sloggett, Anna Georgieva, Sofia Bartholdy, and Kris Duoma. 2018. Guidance and Case Studies for ESG Integration: Equities and Fixed Income. CFA Institute: Charlottesville, VA.