-

-

Search

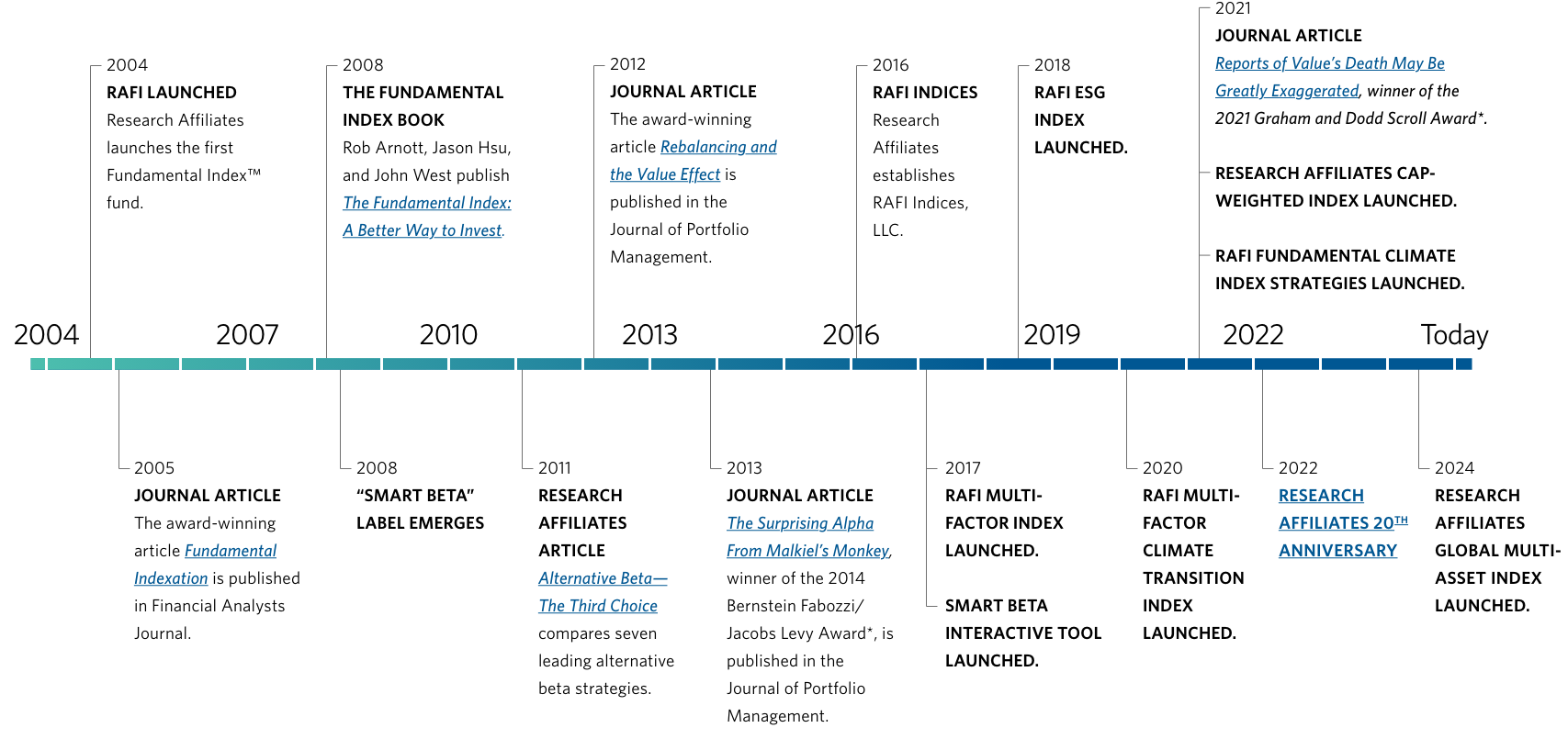

As a financial advisor, you are deluged with constant information and market noise. We at Research Affiliates focus on the long run, question conventional thinking, and separate repeatable return sources from the noise. Decades of academic rigor ground our time-tested solutions, tools, and insights that can help you produce better client outcomes.

Seeking better outcomes for advisors and clients since 2002

Leaders in smart beta and asset allocation

200+ products offering RA approaches

Published 425+ articles

$150 billion follow our strategies

3+ million hits on interactive tools

Products

Through our ongoing research efforts, we design and evolve innovative and systematic strategies that aim to deliver more-efficient long-term returns and fill gaps in the marketplace.

- ETFs

- Mutual Funds

- Targeted Solutions

- Multi-Factor Solutions

- Multi-Asset Solutions

RAFI™

|

All Asset

|

RAE

Research Affiliates Fundamental Index (RAFI) strategies aim to generate consistent outperformance over capitalization-weighted approaches while retaining the benefits of passive investing.

Seek outperformance via contrarian rebalancing

Seek outperformance via contrarian rebalancing

RAFI strategies systematically rebalance holdings to fundamental measures of firm size. Because stock prices fall or rise faster than their fundamentals, RAFI "buys low and sells high" with the goal of harvesting a return premium.

Trade at a valuation discount to passive exposure

RAFI strategies trade at persistent and dynamic valuation discounts to passive approaches. As value stocks cheapen, the strategies systematically increase their valuation discount to benefit from long-horizon mean reversion.

Retain the

advantages of

passive investing

RAFI strategies provide transparency and broad diversification throughout the investment process at low all-in costs and expenses.

All Asset

The PIMCO All Asset strategies aim to maximize investor returns while providing portfolio diversification and inflation protection.

The All Asset strategies are managed to achieve high returns in excess of inflation over a full market cycle.

Provide Portfolio Diversification

Designed to diversify away from mainstream stock and bond markets, the All Asset strategies aim to deliver a complementary return pattern to traditional portfolio holdings.

Protect Against Inflation

By focusing on inflation-sensitive and diversifying investments, the All Asset strategies are designed to protect investors from the damaging effects of rising inflation.

RAE strategies are systematic active equity solutions that seek to generate superior risk-adjusted returns. They exploit market inefficiencies and incorporate well-researched active insights that cannot be optimally accessed through an index chassis.

Anchor

on Valuations

The RAE strategies use multiple ratios, normalized across styles and sectors, to provide a robust measure of a firm’s valuation.

Favor High-Quality Companies

Measures of earnings integrity, distress, investment, and profitably are employed in the RAE strategies to identify financially healthy companies.

Recognize Momentum

Risk-adjusted and “fresh” price momentum inform active share and trade timing in the RAE strategies.

ROB ARNOTT

Founder and Chairman

“We look at investment problems with a fresh eye. Where is conventional wisdom ignoring the lessons of history? Where does it lead investors astray? Where is ‘best practice’ missing the mark? Can we create a better solution to serve our customers? As we answer these questions, we help our clients reach their goals. We succeed by helping others succeed.”

ROB ARNOTT

Founder and Chairman

“We know that replicating others’ ideas is an assured path to average returns. Instead, we ask a few questions to explore investments from a different perspective. Where is conventional wisdom ignoring the lessons of history? Where does it lead investors astray? Where is ‘best practice’ missing the mark? Can we create a better solution to serve our customers? As we answer these questions, we help our clients reach their goals. We succeed by helping others succeed.”

"Achieving our mission of transforming the global investment community for the benefit of investors requires courage, conviction, and commitment to consistently advocate for better investor outcomes and challenge conventional beliefs. We are our people, and our people strive to significantly and positively impact investors’ ability to build wealth over the long term through both insights and strategies. "

KATRINA SHERRERD

Vice Chair,

Chief Executive Officer

CHRIS BRIGHTMAN

Partner,

Senior Advisor

“We study capital markets to learn about historically reliable sources of investment returns. Publishing our research and educating investors are worthwhile activities on their own, but also invite others to challenge our ideas. Publicly debating our research findings is essential to deepening our knowledge. Ultimately, we apply our insights using 21st century technology to create simple, transparent, low cost investment strategies that deliver more of the available returns to end investors."

Research Affiliates

Model Portfolios

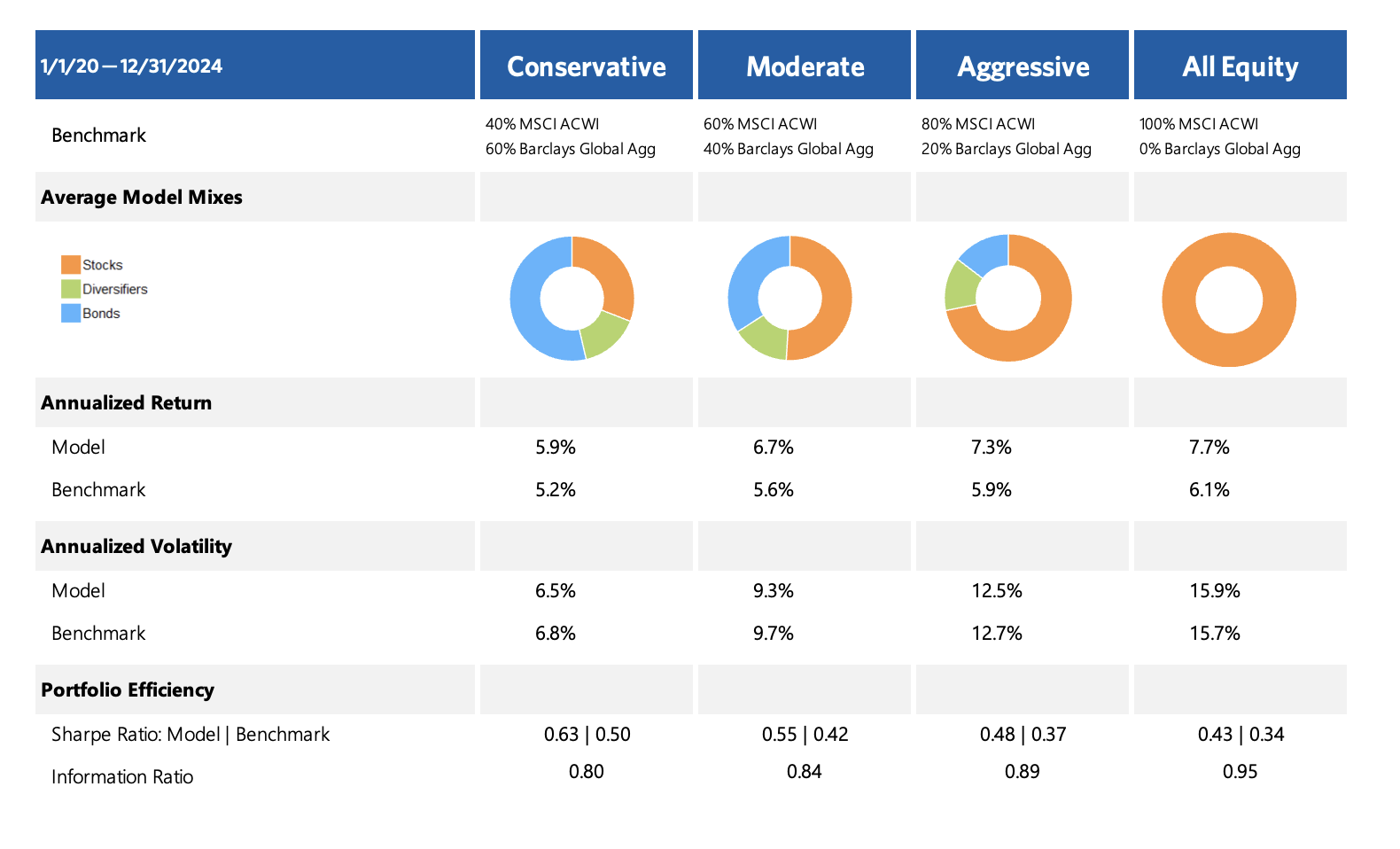

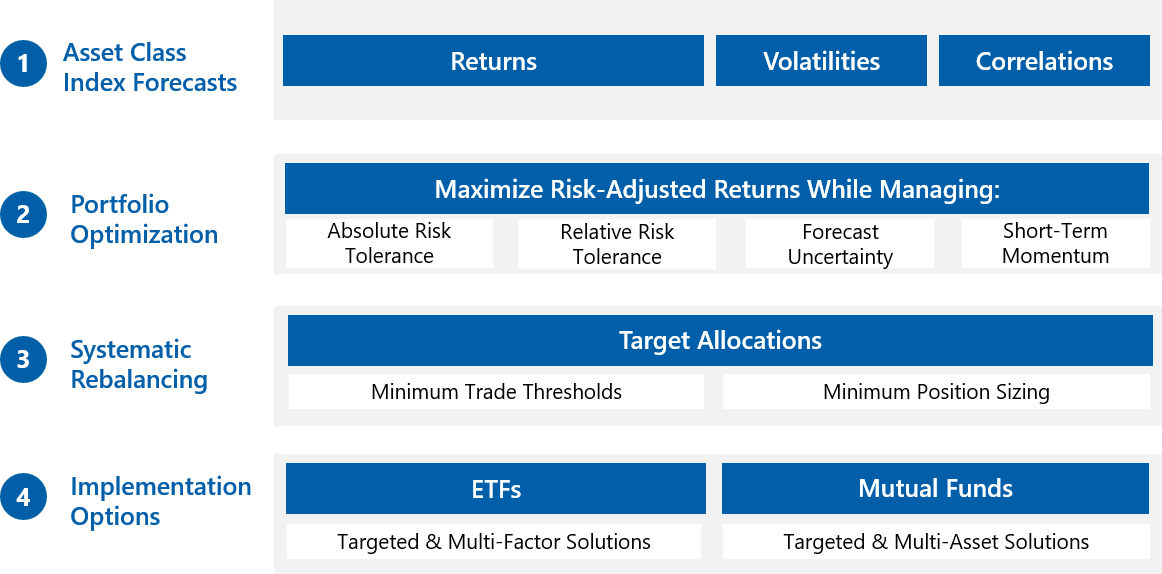

Our suite of model portfolios uses a robust, adaptive, and disciplined approach that is informed by decades of research and experience. We apply a systematic asset allocation process to a diversified roster of 16 liquid asset classes. The resulting allocations offer a starting point for well-crafted strategic positioning in client portfolios.

- Current allocations and positioning

- 25+ mutual fund and ETF tickers

- 10-year expected return forecasts

- 25 years of performance history

- Historical statistics and scenarios

- Investment process

*Models shown are intended for investment professionals only and not the retail public. Your use of this information does not create an investment advisory, fiduciary, or professional services relationship between you and Research Affiliates, LLC. Investors may be required to meet certain suitability and geographic requirements and therefore should consult the provider or a financial adviser for additional information.

Sign up for Model Portfolio updates

Portfolios

|

Robust

|

Adaptive

|

Disciplined

Portfolios

LOG IN TO VIEW...

Performance is based on data from Bloomberg and MSCI. Returns reported in USD. The simulated performance of the models shown is calculated using indexes only, does not reflect the performance of any actual investment product, and does not reflect any fees that may be charged in connection with implementing the model portfolio. Actual investment results will differ. Please see https://www.researchaffiliates.com/legal/disclosures for additional important information regarding hypothetical performance.

Robust

Our model portfolios are built upon four decades of peer-reviewed research. Our approach is grounded in long-term evidence tested over multiple market cycles and asset classes. With an embedded base of robust, long-horizon research, advisors can help clients embrace long-termism and move forward confidently, prepared for the inevitably wide range of short-term results.

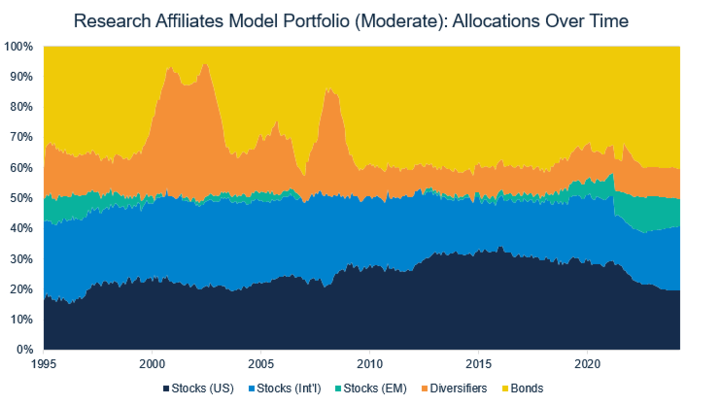

Adaptive

Past is not prologue. Static portfolios of mainstream assets may miss opportunities for long-horizon mean reversion. Further, some asset classes are better used opportunistically based on current yield levels than in a set-it-and-forget-it approach. Our portfolio weights are responsive to changing asset-class yields and dynamically adjust to corresponding changes in long-term expected returns.

Source: Bloomberg, CRSP, Compustat, Datastream, and MSCI.

Disciplined

Sticking with diversification and weathering bear markets is hard. Our portfolio weights are arrived via a transparent and rules-based approach that counters the behavioral bias to abandon recently underperforming assets. Our systematic asset allocation process ensures a contrarian approach that rebalances into newly cheap asset classes to take advantage of long-horizon mean reversion.

Investment Process

For illustrative purposes only. As of December 31, 2021 and subject to change.

Education

Our long history of providing investor tools and sharing actionable insights allows advisors to communicate long-horizon academic concepts, maximize the value of advice, and focus on what matters in the midst of the market’s constant noise and stimulation.

Timely Insights

Advisor Essentials

- How to Invest

- Mutual Funds & ETFs

- Institutional, SMAs, and Commingled