A recession may already be under way. Even if not, the Fed’s actions greatly increase the risk of a recession in the months ahead.

The Fed’s tardiness in tackling inflation raises the probability that policy makers overreact, increasing uncertainty and the likelihood of a recession.

Policy makers need to deal with each of the individual sources of inflation in a coordinated fashion. Using a blunt instrument, such as a rate hike or quantitative tightening, merely crushes demand.

Given today’s relatively high level of uncertainty, business leaders owe it to their shareholders to engage in risk management.

Recessions do not naturally begin in an economy with two job openings for every job seeker. That said, there’s nothing natural about recessions. In 1998, MIT economist Rudi Dornbusch observed that “none of the post-war expansions died of natural causes, they were all murdered by the Fed.” The motive for this murder is usually to save the economy from incipient inflation by killing the economy.

Now is a time of heightened uncertainty, with many forces driving that uncertainty. We have an inflation rate at a four-decade high. Most don't remember the last time inflation was at this level. The Fed has not had to deal with serious inflation in the past 40 years and the responses adopted now will likely slow the economy. The Fed is very late to the game because the board members were in denial for a long time. In November 2021, the Fed finally officially retired the word transitory after dismissing the inflationary pressures with that description far too long. We might be surprised that the Fed did not see this coming, but the Fed’s track record on forecasting, whether the economy or inflation, is rarely better than a Ouija board.

Create your free account or log in to keep reading.

Register or Log in

Inflation’s Causes, Prospects, and the Fed’s Toolkit

Inflation is a simple consequence of a supply/demand imbalance. If demand exceeds supply, prices rise until balance is restored. The current surge in inflation has been caused mainly by blowout spending, supply chain disruptions—some related to Covid lockdowns and some to geopolitics—the Russia-Ukraine war, and working from home, which leaves people with more money to spend, even as many produce less goods and services. Which of these can the Fed influence? None? Is the Fed powerless to rein in inflation? Not at all. Central bankers can decrease demand, albeit with serious lags, even if the problem is on the supply side.

To a person with a hammer, everything looks like a nail. With an echo-chamber guiding monetary policy all over the world, the only answer that seems to resonate with central bankers is to decrease demand. None of this is to say that the Fed should continue with a dozen years of negative real rates. Jerome Powell faces the same problem as poor Iain MacDougall, lost in the Scottish countryside. MacDougall asks a local, “How do I gae to Dundee?” The local replies, “Well, I would nae start from here.” Jerome Powell inherited a Fed after a half-dozen years of negative real interest rates, which he has continued to this day.

The 40-year comparison is much talked about. Many of our current problems are self-inflicted by an extended period of negative real rates. Indeed, with robust economic growth, low unemployment, and stock markets at all-time highs, it is baffling that the Fed continued with quantitative easing and persisted in keeping short-term nominal interest rates at essentially zero. In contrast, in 1981, the fed funds rate was 19%.

We liken real interest rates to a speed bump. Too high and traffic is stopped: innovation, long-horizon investment in new initiatives, entrepreneurial capitalism all slow markedly. Too low and reckless driving ensues: if we are among those able to borrow at negative real rates, we will, whether we have good ideas for the money or not. Misallocation of resources and malinvestment—at the individual, corporate, and government level—naturally will follow, along with propping up zombie companies that clog the runway for the innovators. All of this in turn inhibits innovation and entrepreneurial capitalism, both because risky projects cannot access those ultra-low rates, and established enterprises and government may waste much of the free money at their disposal.

Being late to the game increases the probability that the Fed overreacts, because it didn't act soon enough. This increases uncertainty and elevates the probability of a hard landing, which is what everybody wants to avoid. Hard landing means we go into a serious recession, like the one associated with the global financial crisis. There are huge economic as well as human costs associated with hard landings. Nobody wants to be laid off or to spend an extended amount of time on unemployment insurance. A soft-landing scenario is much more desirable. That could mean slower economic growth or maybe a mild recession before the economy moves into a recovery phase.

The main issue is that the Fed ignored inflation for far too long. One of the main things we worry about is that the Fed board members believe that increasing interest rates is sufficient to fine tune inflation. If they really believe that, it's dangerous. Outsiders are not privy to what happens at the FOMC other than reading the summary minutes, because the detailed minutes are only released after five years. Traditionally, interest rate hikes have been the go-to tool in a tightening regime and have had some historical success. But this time might be different. Indeed, every time is different.

What are the root causes of the inflation we have now? Some of them are intuitive, such as supply chain disruptions. Will the Fed’s raising interest rates by 75 basis points make a difference to supply chain disruptions? No. To deal with inflation, we need to deal with the source of the problem and address it directly, not just hit it with a blunt instrument that sometimes worked in the past. The usual approach does not inspire confidence. We worry the Fed is going to mess it up.

Step number one is to go through the individual components driving the 8.6% CPI inflation number. Consider housing, for example. Given that a homebuyer can get a mortgage for much less than 8.6% means that effectively the financing is free or being subsidized. In terms of real rates, this increases the demand for housing. So, for this component, raising rates appears to have some logic. That is the sort of analysis we need to see. But the housing issue is much more complex, encompassing not just the demand for mortgages, but the demand for materials, and the structural backlog caused because we have not been building enough housing over the last five years. The rise in housing prices has nothing to do with Covid.

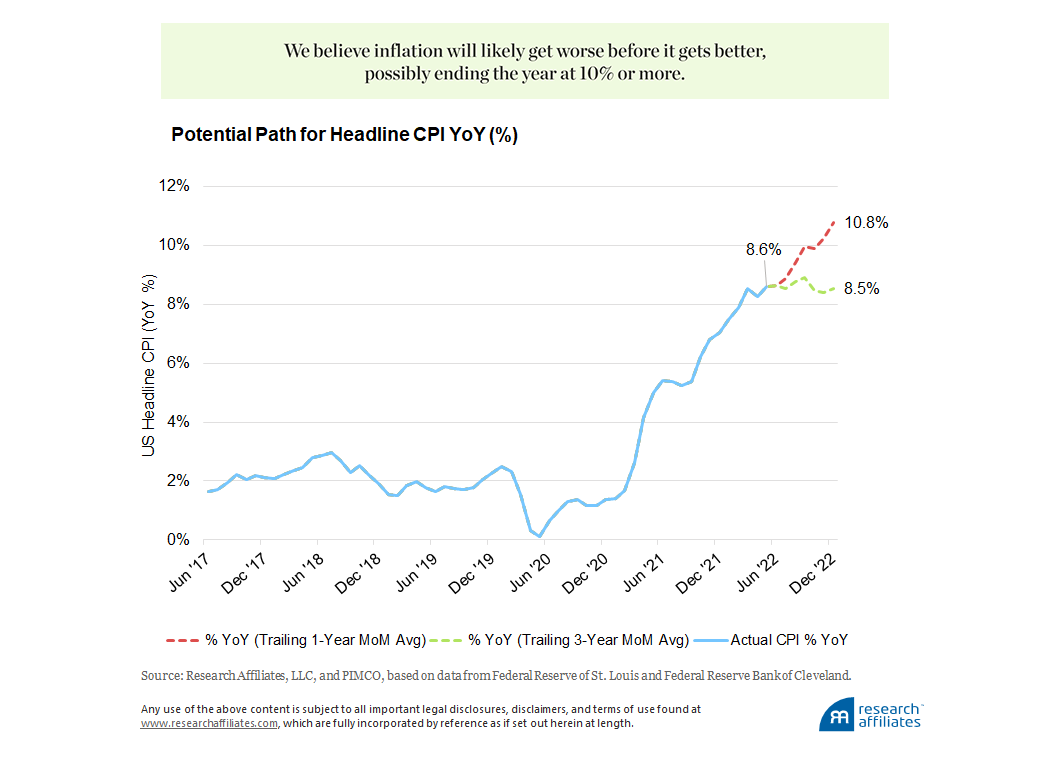

The near-term prognosis for inflation is not good. Each month’s 12-month inflation rate matches the previous month’s inflation rate, plus a new month, minus the corresponding month dropped from the previous year. We can’t know with any confidence what the new month’s rate will be, but we know with precision the rate of the month being dropped. The next four months to be dropped from 2021 will be 0.9%, 0.5%, 0.2%, and 0.3%, respectively. The Cleveland Fed produces an “inflation nowcast” which estimates what the monthly inflation would be if the month ended today. If their nowcast is correct, the 0.9% from June 2021 will be replaced with 1.0% for June 2022. If inflation in each subsequent month through year-end 2022 matches the average inflation rate over the prior 12 months, we should finish the summer at 9.9% and finish the year at 10.8%. If, alternatively, monthly inflation recedes to match the trailing 36-month average, then the current 8.6% inflation rate would remain steady through year-end. This simple analysis leads us to believe that inflation will likely get worse before it gets better.

There’s another problem with the way CPI inflation is calculated. The largest component, shelter, is one-third of the total and is smoothed and lagged. According to the Bureau of Labor Statistics (BLS), their chosen measure for the cost of home ownership, owners’ equivalent rent (OER), is up 7.3% in the last two years, while the S&P/Case-Shiller Home Price Index shows that US home prices have risen by 37% in the two years ended March. The BLS switched to OER after the last inflationary surge in 1979–81; indeed, if inflation was calculated today like it was in 1981, we would already be solidly into double digits.1

Similarly, the BLS estimate of rental prices, rent of primary residence (RPR), is up a near-identical 7.1% in the last two years, while the CoreLogic Single-Family Rent Index is up twice that in the last year alone (and an astounding 41% in Miami!). The BLS uses survey data to gauge shelter inflation. Homeowners’ perceptions of their property rental values anchor on the past and only respond to soaring home prices slowly, gradually, and over several years.

The one-third of CPI for shelter will be playing catch-up for some years to come. Empirically, most of that catch-up occurs over the subsequent two to three years. Note that this inflation has already happened; it simply hasn’t made its way into CPI quite yet.

Suppose the Fed identified five major causes of inflation and how it plans to deal with each of them. Wouldn’t this approach instill greater confidence in investors and business leaders? Unfortunately, the Fed has no control over most of the current causes of inflation, but could work with the Treasury to address some of these at a fiscal level.2 Consistent with the policy response in the global financial crisis, we need a coordinated effort within our government to reduce uncertainty and to lay out a plan to reduce inflation—component by component.

Here is an example of the type of actions that can help. Long Beach, California, hosts the largest container port in the United States. Given current supply chain issues, the port had a long backlog and considerable wait for container ships to unload. The City of Long Beach had a regulation that allowed the stacking of only two containers, designed to keep the containers from blocking residents’ view of the ocean. Realizing the bottleneck at their port was causing a national problem, the City of Long Beach changed the regulation, allowing four or five containers to be stacked. While inconvenient for citizens in the short term, the City of Long Beach did something to help the nation.

Hundreds, if not thousands, of opportunities like this exist. These initiatives focus on supply. In contrast, the Fed is focused on 75 basis-point rate hikes. Each of the causes of inflation needs its own policy response. None will typically respond as predictably or quickly to aggressive tightening by the Fed.

Preparing for Recession versus Reacting to Recession

Uncertainty is a negative force and is a question of degree. When a war is going on, especially involving a nuclear power (as is the case now), that's a big deal, much different than a regional war that doesn’t involve a nuclear power. The degree of uncertainty is key. An average level of uncertainty is always present, but the level can fluctuate. When the level of uncertainty is relatively high, as it is today, business leaders should actively manage their risk.

What does risk management look like? Let’s say, for instance, that a corporation has a promising project which entails building a new plant. Management believes this investment will enhance its long-term value. It increases investment, employment, economic growth, all good things, but the corporation needs to finance the plant. At this point in time, do you want to bet on the company given the current uncertainties? This isn't theoretical. With inflation running at a 40-year high, major geopolitical disruptions around the world, monetary and fiscal policies in flux, the logical tactic is to exercise caution.

When the level of uncertainty is relatively high, as it is today, business leaders should actively manage their risk.

”In his 1986 PhD dissertation, one of us (Cam Harvey) was the first to show that a yield-curve inversion has a perfect batting average in forecasting recessions since 1968. The other (Rob Arnott) has suggested that a yield-curve inversion doesn’t predict recessions, it causes recessions. The long end of the yield curve is mainly a market rate set by the market’s perception of the fair cost of long-term capital. The short end is largely managed by the central bank. If the central bank raises the short-term cost of risk-free capital above the long end, it is choosing a rate the market tells us is too high. This isn’t necessarily the case in an economy (Europe or Japan) where the central bank also controls the long end of the yield curve (in policy circles, this is called yield-curve control). But, when the free market determines the long end of the yield curve, the Fed should pay close attention!

On June 30, 2019, when the yield curve had inverted for a full quarter, Cam was frequently interviewed by the media, explaining that this signal was “code red” for recession. All previous eight episodes [since October 1968] of inverted yield curves were followed by recessions, with no false signals. Some criticized his statements as potentially causing a recession. No, his warning was risk management 101. Facing a red flag, a business would be ill-advised to bet the firm on that new plant.

Today, the yield curve is not inverted, so why worry? As with the recent two-fold surplus of job openings relative to job seekers, this too shall pass. Really? The forward markets do a pretty good job of forecasting near-term Fed decisions and they are suggesting a 90% likelihood of a 75 basis-point hike in July followed by another 50 to 75 basis points in September. Those moves would take the 3-month Treasury bill yield to about 3%, within hailing distance of the current 3.15% yield on the 10-year Treasury bond. Absent a run-up in long bond yields, one additional hike before year-end would leave us with an inverted yield curve. Further, Cam's analysis shows the slope of the yield curve is the key indicator. A flat curve is bad and an inverted curve is really bad for economic prospects.

For a consumer maybe it isn't the time to take that trip to Disney and use your credit card to finance it. Uncertainty can slow economic growth, but slowing economic growth is a lot better than going into a hard landing unprepared. A company that chooses not to undertake new investment in a proposed plant will likely survive the recession, but if it rolls the dice and forges ahead, it might not survive. The costs of failing are high, but the costs are not just economic. Of course, the company’s shareholders would lose given its falling stock price. These losses are easy to measure and tend to dominate the headlines. However, the human costs are high when people are thrown out of work. These hardships are much more difficult to quantify, but they are real and large. Too often, the human costs are ignored.

Many companies took Cam’s warning in 2019 very seriously, and indeed when Covid hit, they were in reasonably good shape. No single industry faced an existential crisis as a result of Covid, although some industries, especially hospitality, restaurants, and retailers, were more negatively affected than most. But this was not like the global financial crisis when a single industry, financials, faced a risk of collapse and/or nationalization. Some people were ready because they knew an inverted yield curve was a reliable red flag. Today the heightened uncertainty is obvious. We think that means people will be cautious and they will engage in risk management.

It’s Not Too Late to Prepare

If we are not already slipping into recession, we see a substantial probability that a recession could start in late 2022 or 2023. If we are right, then the CEO of a company that gets into real trouble in the recession can't go on stage at the shareholders’ meeting or on the quarterly earnings call and say management was blindsided by the recession. That's not good enough. People would laugh at them. The signs of recession are in your face. The way to deal with it is to be more conservative until some of the uncertainty is resolved.

End Notes

- In "The Coming Rise in Residential Inflation" available on SSRN, Bolhuis, Cramer, and Summers (2022) argue that "the current inflation regime is closer to that of the late 1970s than it may at first appear."

- This need not be a pipe dream. The Fed and Treasury have not been this close since the early 1970s when Arthur Burns, Economic Advisor to the President in the Nixon Administration, was subsequently Fed Chair from 1970 to 1978. We know how that turned out, but cooperation and collaboration can, just as easily, lead to good outcomes.