Both academic research and our own experience indicate that the business case for corporate diversity is compelling as a result of higher collective intelligence.

Testing the investment case for greater diversity faces two major challenges: insufficient historical data and difficulty in measuring whether the culture is one that embraces dissenting views among the team.

Accordingly, we conclude that investors who seek to promote diversity and its business benefits would be well served to combine diversity with known drivers of excess returns.

Abstract

The broad business case for diversity is compelling. Research shows that cognitively diverse groups have higher levels of collective intelligence than nondiverse groups, resulting in greater creativity and innovation as well as in more-effective corporate leadership. The investment case for diversity is less clear-cut because researchers simply lack the necessary data to determine whether a link exists between diversity and portfolio performance. Given what we know (and do not know) now, we encourage investors who seek to promote diversity and its business benefits to use investment strategies that combine diversity with known sources of excess returns in the pursuit of investment performance.

Diversity is a word with many meanings. Given its primary definition relates to “a range of different things,” it should not be surprising that a conversation about the benefits of diversity is multi-faceted. The broad business case for diversity is compelling. Research shows that cognitively diverse groups, which interact in a culture that embraces dissent, candor, and respect for other viewpoints (an inclusive culture), will tend to make better decisions. In general, cognitively diverse groups have higher levels of collective intelligence than nondiverse groups, resulting in greater creativity and innovation, as well as in more-effective corporate leadership.1

The narrower investment case for diversity is less clear-cut, because researchers simply lack the necessary data to determine whether a link exists between diversity and portfolio performance. Indeed, we can test the relationship between observable measures of diversity and cross-sectional firm characteristics, but it is much more challenging to test the robustness of whether more-diverse firms are better investments in a portfolio context. An additional challenge is that the corporate advantages associated with greater diversity are dependent on an inclusive culture. (In the extreme, homogeneity of thought is no different than one individual making all the decisions; curiosity regarding divergent views is essential to unlocking the benefits of diversity.) Corporate culture, however, is exceedingly hard to measure—particularly on a large scale across thousands of firms around the globe.2 Therefore, the ability to ascertain with any degree of definitiveness if diversity attributes are priced in, or if they should lead to otherwise unanticipated excess returns, is limited at this time.

The good news for investors is that the growing attention paid to gender diversity and the issue of gender disparity over the recent past has led to increased transparency, more research, and ever-broader reporting of gender statistics. With time, the data and the research will extend past gender into other areas of diversity, such as race, ethnicity, age, and cognitive differences, providing more insight and direction for investment strategies. In the meantime, investors who seek to promote diversity as a social choice as well as for its broad business benefits may prefer to rely on investment strategies that pair diversity with known return-driving metrics in the pursuit of investment performance.

Cognitive Diversity: The Antidote to Groupthink

Research documenting the benefits of diversity on decision making and innovation continues to build. The most reliable results come from the social sciences and behavioral economics,3 fields in which well-designed research protocols can isolate the specific elements of how humans interact and make decisions. In these studies, researchers show that randomly selected groups of people perform better than the single most-intelligent person (as measured by intelligence quotient, or IQ) in the group. In fact, such randomly selected groups outperform collectives of highly intelligent individuals, including experts, when the latter do not interact with each other to solve problems.

In many ways, the benefits of diversity in decision making are analogous to the benefits of diversification in investment strategies. Two people, whose views are not perfectly correlated, will consider more (and different) facts and perspectives than either one would on their own. Assuming mutual respect and curiosity, their dialogue should lead to a more comprehensive assessment than would otherwise be the case. Consider the number of times a reader finds typos in another’s document when that person could not see the obvious after having spent hours with the material! Adding more points of view, if different from the existing perspectives (that is, less than perfectly correlated), can continue to improve decision making, up to the point of diminishing returns when the “cost” of including another person in the deliberations outweighs the benefit of adding another point of view.

To achieve better corporate outcomes (distinct from better investment outcomes), a firm needs both cognitive diversity among its ranks and a culture that embraces dissent, candor, and respect for other viewpoints (an inclusive culture) or the group easily devolves into proverbial groupthink. The antidote to groupthink involves two distinct but necessary parts: 1) put in place a cognitively diverse team and 2) create an environment that values curiosity, respect, and independent—even dissenting—views.

The first part of the antidote to groupthink, hiring a cognitively diverse team, is difficult given humans’ well-documented preferences/biases and faulty intuition. We tend to select new hires with whom we instinctively identify or who appear to be the perfect “fit” for the position we are trying to fill. Hiring decisions are too often guided by heuristics, or rules of thumb, that are dominated by past experiences and by feelings of like and dislike, with little deliberation or reasoning.4 To illustrate, consider what happened after the Boston Symphony Orchestra started to audition musicians behind a screen to prevent visual biases and preconceived notions of what a top musician should look like from influencing hiring decisions. In 1970, before this practice was adopted, less than 5% of musicians in the top five US orchestras were women. By 2016, after most orchestras adopted the so-called blind audition, women accounted for more than 35%.5 The good news is that awareness of the hurdles to achieving true diversity is leading to better management practice—including adapting the blind audition model for the corporate hiring process (Bohnet, 2016, and Bisoux, 2017).

The second way to combat groupthink is to cultivate a culture that provides a safe environment for expressing independent views and encouraging curiosity—particularly around different points of view, information, and evidence. To state the obvious, assembling a team of people who are cognitively diverse but afraid to voice different views or work with their colleagues to solve difficult problems is unlikely to harvest the benefit of the team’s diversity. In fact, Nemeth (2018) argues that teams need authentic “dissenters” to stimulate more complex thinking by the group and to mitigate the tendency of group members to “go along to get along.”

Nemeth shows that serious problems arise when cultural norms foster consensus and suppress dissent—as was the case with the Kennedy Administration’s team dynamics that led to the failure of the Bay of Pigs in the early 1960s.6 Groupthink has also been linked to disastrous corporate decisions. One example is Swissair’s persistent belief, upheld by a homogenous board, that it was invulnerable to the unique competitive environment of European airlines, even as it slid steadily into bankruptcy (Hermann and Rammal, 2010). And sadly, dissent-inhibiting cultural norms may have contributed to major airplane crashes and significant loss of life, such as occurred on Avianca Flight 52 and Korean Air Flight 801 (e.g., Gladwell, 2008).

Disavowing groupthink and taking steps to establish a corporate culture that embraces diversity and nurtures inclusion is the key to good management practices that produce better corporate outcomes.

Board Diversity: What the Data Tell Us

The impact of diversity on firm success may be most visible in the context of board diversity, in large part because of the many high-profile efforts to promote greater representation by women on corporate boards. These public and actively debated initiatives have yielded a very concrete benefit to investors, starting with the accumulation of new data. Empirical studies of the impact of board diversity on firm performance show mixed results. Several researchers, such as Singh, Vinnicombe, and Johnson (2001), Nguyen and Faff (2007), Campbell and Minguez-Vera (2010), and Hunt, Layton, and Prince (2015), have found that firms with greater female board representation tend to be more profitable and/or to elicit positive stock market reactions. Others, such as Bohren and Strom (2010) and Darmadi (2011), have found that greater board diversity tends to be associated with lower accounting performance and to be less attractive to investors.

Much of the dispersion in results may be caused by factors distinct from the gender attributes of corporate boards. For instance, the literature reveals that female board members tend to have more-limited business backgrounds, have less CEO experience, be younger, and more likely hold advanced degrees—a fact that makes it difficult to make direct comparisons (e.g., Carter et al., 2010, and Hillman, Cannella and Harris, 2002). Ahern and Dittmar (2012), for example, show that the resulting negative impact on firm value from the Norwegian mandate on gender representation could be explained by younger ages and by less managerial work experience, rather than by the gender of the new board members.

Post and Byron (2015) reconcile many of the conflicting findings by addressing a crucial shortcoming in the existing literature, namely, that the environment matters to the results. They find that a positive link between board diversity and firm performance exists in countries which exhibit stronger shareholder protections and greater gender diversity, while the opposite tends to be true in countries with weaker shareholder protections and lower gender parity. In other words, strong shareholder protections may motivate directors to more actively elicit and systematically process information from all board members, which echoes an earlier point: culture matters in deriving the benefits of diversity.

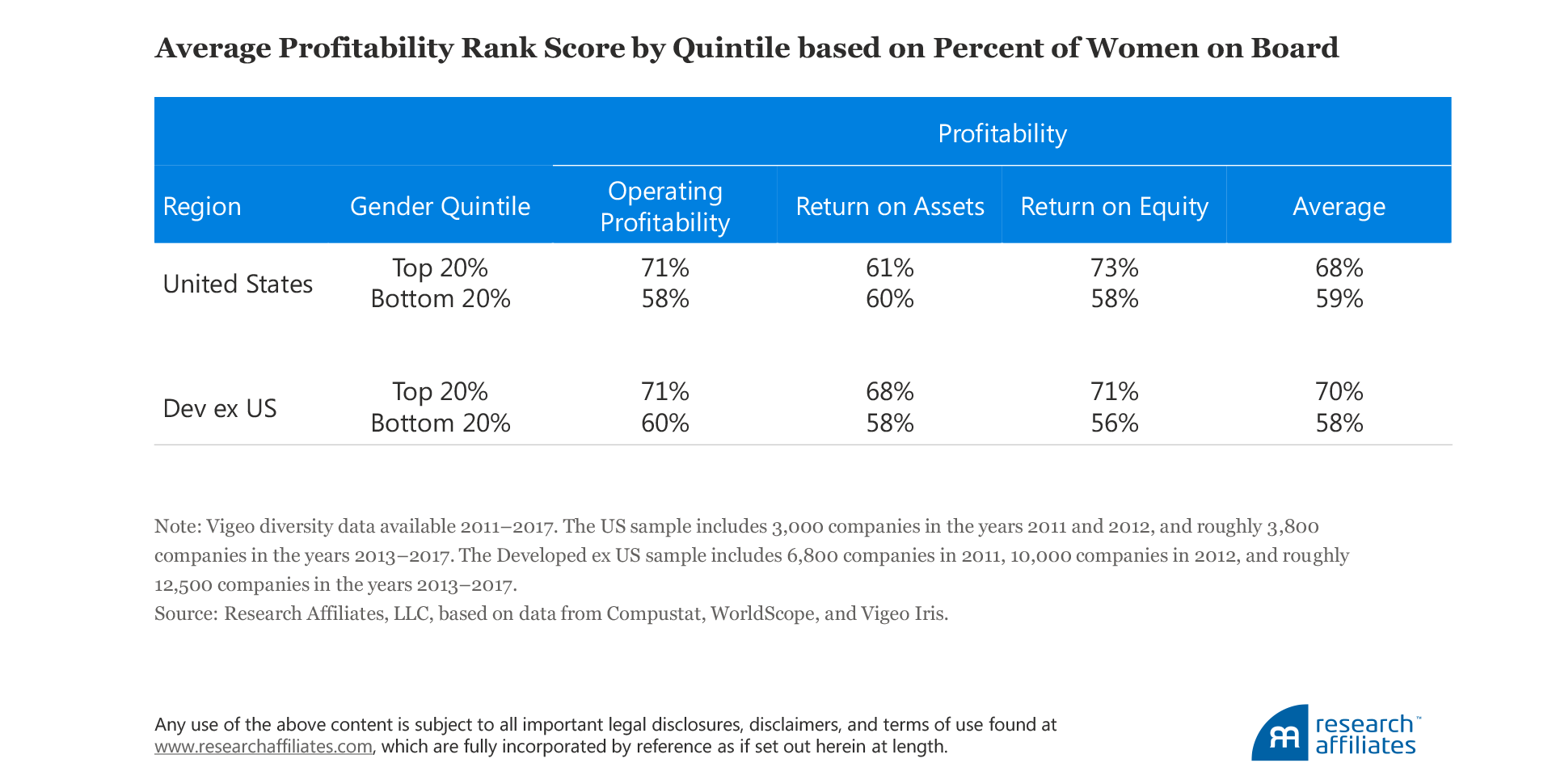

Our own research confirms that companies with greater diversity at the board level also tend to be more profitable, although this finding does not imply causality. In our analysis, we gauged the relation between board diversity, as measured by the percentage of women on the board, and profitability, using three different definitions of profitability: operating profitability, return on assets, and return on earnings. The varying definitions allow us to check the robustness of our conclusions.

We sorted companies, separately in the US market and developed markets ex US, into five groups based on the percentage of women on the board. We calculated the rank score of each firm’s profitability relative to its own industry. The higher the rank, the higher the company’s profitability relative to its peers. We then compared the average profitability rank of the companies in the top quintile and those in the bottom quintile. Across all US firms during the sample period, the average profitability rank score in the top quintile by women on the board was 68% compared to 59% for the bottom quintile. Outside of the United States, the results are comparable, with an average profitability rank of 70% for the top quintile versus 58% for the bottom quintile.

In our analysis, using the same method described earlier, we see no relation between board diversity and the return drivers of investment, issuance, and accruals. Thus, while some data suggest that gender diversity on boards may be correlated with profitability, at this time it remains uncertain whether tilting investment toward companies with greater gender diversity on their boards is, in and of itself, sufficient to achieve better investment outcomes.

This, of course, takes us back to the limitations associated with relying solely on diversity metrics as they exist today in investment strategies: the available gender data are at best a rough indicator for cognitive diversity and collective intelligence, and thus a noisy proxy for firm decision-making effectiveness. To achieve desired investment outcomes, investors will benefit from pairing diversity metrics with known sources of excess return.

Conclusion

In addition to being the ethically “right thing to do,” our review of the literature on diversity leads us to conclude that the business case for diversity is convincing. Businesses that recognize the importance of cognitive diversity and that foster curiosity, authentic dissent, and mutual respect tend to avoid groupthink and make better decisions. These businesses should be best positioned to benefit over the long term on a number of dimensions of corporate success, including financial success.

We are unable to conclude, however, that diversity is a robust return driver. We simply do not have the necessary data to determine whether a link exists between diversity metrics and portfolio performance. Nonetheless, given the notorious instances in which poor decisions in the absence of cognitive diversity and a culture of expressing dissenting views led to unfortunate outcomes, it is understandable that investors might prefer to trust their investment dollars to more cognitively diverse companies, all else equal. We encourage investors who seek to promote diversity and its business benefits to use investment strategies that combine diversity with known sources of excess returns in pursuit of their dual objectives.

Endnotes

1. Li, Sherrerd, and Treussard (2018) provide a summary of research related to cognitive diversity and business outcomes.

2. See Graham et al. (2018) for a field survey that addresses the importance of culture across over 1,000 North American firms and the relevant references therein.

3. In addition to Woolley et al. (2010), see Page (2007) for an examination of the logic of cognitive diversity; Bohnet (2016) for a review of research on gender diversity, bias, and research-based solutions; and Nemeth (2018) for why culture is important to realizing improved decision making and creativity.

4. Kahneman (2011) provides a detailed explanation of the way humans think, and Bohnet (2016) offers a review of bias research, which includes both the impact of bias on decisions such as gender gaps and the ways to reduce the negative impact of our biases in our environment. Nemeth (2018) discusses humans’ natural preference to be liked and to join majorities, as well as the potentially negative impact of those tendencies on decision-making outcomes.

5. Bohnet (2016) and Gladwell (2005) provide more discussion of these biases. Of course, even if certain biases are removed from the hiring process, others remain and not all inequities are resolved. For instance, a female flutist with the Boston Symphony Orchestra is suing for equal pay with her male counterpart under a new state law in Massachusetts (Tsioulcas, 2018).

6. See Nemeth (2018) for a description of the failures and the lessons learned by the Kennedy Administration in 1961, which prevented subsequent poor decisions a year later during the Cuban Missile Crisis.

7. A number of studies, including Roll (1986), Boudoukh et al. (2007), Fama and French (2006, 2008, 2015), Hou, Xue, and Zhang (2015), and Ball et al. (2015), have contributed to the literature on the link between corporate attributes and return.

References

Ahern, Kenneth, and Amy Dittmar. 2012. “The Changing of the Boards: The Impact on Firm Valuation of Mandated Female Board Representation.” The Quarterly Journal of Economics, vol. 127, no. 1 (February):137–197.

Arnott, Rob, Campbell Harvey, and Harry Markowitz. 2018. “A Backtesting Protocol in the Era of Machine Learning.” Available on SSRN.

Ball, Ray, Joseph Gerakos, Juhani Linnainmaa, and Valeri Nikolev. 2015. “Deflating Profitability.” Journal of Financial Economics, vol. 117, no. 2 (August):225–248.

Bisoux, Tricia. 2017. “Should B-Schools Be Hiring Blind?” BizEd (October 31).

Bohnet, Iris. 2016. What Works: Gender Equality by Design. Cambridge, MA: Belknap Press.

Bøhren, Øyvind, and Øystein Strøm. 2010. “Governance and Politics: Regulating Independence and Diversity in the Board Room.” Journal of Business Finance & Accounting, vol. 37, no. 9 & 10 (November/December):1281–1308.

Boudoukh, Jacob, Roni Michaely, Matthew Richardson, and Michael Roberts. 2007. “On the Importance of Measuring Payout Yield: Implications for Empirical Asset Pricing.” Journal of Finance, vol. 62, no. 2 (April):877–915.

Campbell, Kevin, and Antonio Minguez-Vera. 2010. “Female Board Appointments and Firm Valuation: Short and Long-Term Effects.” Journal of Management and Governance, vol. 14 (February):37–59.

Carter, David, Frank D’Souza, Betty Simkins, and Gary Simpson. 2010. “The Gender and Ethnic Diversity of US Boards and Board Committees and Firm Financial Performance.” Corporate Governance: An International Review, vol. 18, no. 5 (September):396–414.

Darmadi, Salim. 2011. “Board Diversity and Firm Performance: The Indonesian Evidence.” Corporate Ownership & Control, vol. 8, nos. 2:450–466.

Fama, Eugene, and Kenneth French. 2006. “Profitability, Investment, and Average Returns.” Journal of Financial Economics, vol. 82, no. 3 (December): 491–518.

———. 2008. “Dissecting Anomalies.” Journal of Finance, vol. 63, no.4 (August):1653–1678.

———. 2015. “A Five-Factor Asset Pricing Model.” Journal of Financial Economics, vol. 116, no. 1 (April):1–22.

Gladwell, Malcolm. 2005. Blink: The Power of Thinking Without Thinking. New York, NY: Little, Brown, and Company.

———. 2008. Outliers: The Story of Success. New York, NY: Little, Brown, and Company.

Graham, John, Jillian Grennan, Campbell Harvey, and Shivaram Rajgopal. 2018. “Corporate Culture: Evidence from the Field.” Duke Innovation and Entrepreneurship Initiative Working Paper No. 2016-33 (October 11).

Hermann, Aaron, and Hussain Rammal. 2010. “The Grounding of the ‘Flying Bank.’” Management Decision, vol. 48, no. 7 (August):1048–1062.

Hillman, Amy, Albert Cannella, and Ira Harris. 2002. “Women and Racial Minorities in the Boardroom: How Do Directors Differ?” Journal of Management, vol. 28, no. 6 (December):747–763.

Hou, Kewei, Chen Xue, and Lu Zhang. 2015. “Digesting Anomalies: An Investment Approach.” Review of Financial Studies, vol. 28, no. 3 (March 1):650–705.

Hunt, Vivian, Dennis Layton, and Sara Prince. 2015. “Why Diversity Matters.” McKinsey & Co (January).

Kahneman, Daniel. 2011. Thinking, Fast and Slow. New York, NY: Farrar, Straus, and Giroux.

Li, Feifei, Katrina Sherrerd, and Jonathan Treussard. 2018. “Unlocking the Performance Potential in ESG Investing.” Research Affiliates Publications (March).

Nemeth, Charlan. 2018. In Defense of Troublemakers: The Power of Dissent in Life and Business. New York, NY: Basic Books.

Nguyen, Hoa, and Robert Faff. 2007. “Impact of Board Size and Board Diversity on Firm Value: Australian Evidence.” Corporate Ownership & Control, vol. 4, no. 2 (Winter):24–32.

Novy-Marx, Robert. 2013. “The Other Side of Value: The Gross Profitability Premium.” Journal of Financial Economics, vol. 108, no. 1 (April):1–28.

Page, Scott. 2007. The Difference: How the Power of Diversity Creates Better Groups, Firms, Schools, and Societies. Princeton, NJ: Princeton University Press.

Post, Corinne, and Kris Byron. 2015. “Women on Boards and Firm Financial Performance: A Meta-Analysis.” Academy of Management Journal, vol. 58, no. 5 (October):1546–1571.

Roll, Richard. 1986. “The Hubris Hypothesis of Corporate Takeovers.” Journal of Business, vol. 59, no. 2 (April):197–216.

Singh, Val, Susan Vinnicombe, and Phyl Johnson. 2001. “Women Directors on Top UK Boards.” Corporate Governance: An International Review, vol. 9, no. 3 (July):206–216.

Tsioulcas, Anastasia. 2018. “Seeking Pay Equity, Female Flutist Sues Boston Symphony Orchestra.” NPR.com (July 5).

Woolley, Anita, Christopher Chabris, Alex Pentland, Nada Hashmi, and Thomas Malone. 2010. “Evidence for a Collective Intelligence Factor in the Performance of Human Groups.” Science, vol. 330, no. 6004 (October):686–688.